How do you explain payment method?

A payment method refers to the various options available for customers to make payments when purchasing a product or service. Whether in a physical or online store, payment methods cover a range of choices. Commonly accepted payment methods include cash, credit cards, debit cards, gift cards, and mobile payments.

Buyers will use this type of payment when they purchase goods online or offline. They can use different types of online payment methods, including debit/credit cards, wire transfers, net banking, and digital wallets. Online payments can be done at the discretion of consumers.

Payment methods to improve customer experience refers to using a variety of secure and easy-to-use online payment options like credit and debit payments and ACH payments. By offering these choices, businesses make transactions quicker and simpler, helping customers feel more comfortable and boosting loyalty.

These methods include cash, credit / debit cards, bank transfers, mobile payments and digital wallets. They serve as the bridge between consumers and businesses, facilitating the exchange of money. They offer various features and security measures to suit individual preferences and situations.

- Credit Cards. Credit cards offer a quick and convenient way to make financial transactions both large and small. ...

- Debit Cards. ...

- Automated Clearing House (ACH) ...

- Cash. ...

- Paper Checks. ...

- eChecks. ...

- Digital Payments. ...

- Money Orders.

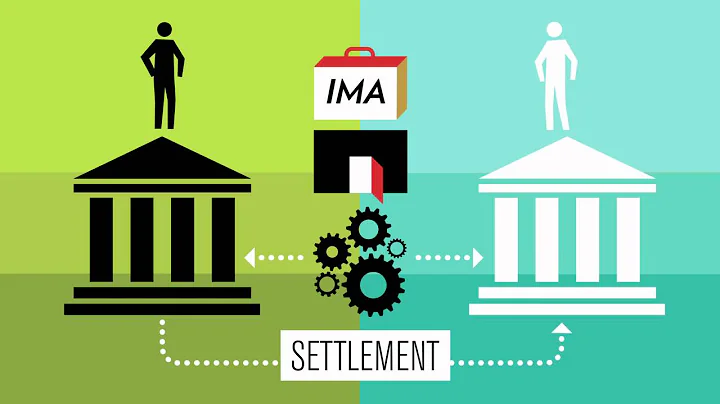

The 'payments system' refers to arrangements which allow consumers, businesses and other organisations to transfer funds usually held in an account at a financial institution to one another.

What are the three main types of payment options. The three most common types of payment in today's market are credit cards, debit cards, and cash. Credit and debit card transactions involve fees paid by merchants to the card companies, but they tend to involve larger purchase amounts than cash transactions.

Credit cards are the most commonly used payment method in eCommerce. Since credit cards are easy and mostly safe to use, the high popularity of using them in online purchases is no surprise.

There are three stages to payment processing: validation, reservation, and finalization. The payment life cycle is related to the order life cycle stages: order capture, release to fulfillment, and shipping. Ensures that a customer has adequate funds to make the purchase.

Credit cards are often viewed as the best payment method because they are convenient, widely accepted, and offer enhanced fraud protection.

What are 2 most common methods of payment?

Cards was still a popular POS payment method in the United States after COVID-19, whilst BNPL had a smaller market share. 40 percent of POS payments that year were being made with credit card. Using a debit card was the second most common payment method, followed by cash.

Cards are still the most-used payment method, with American Express, Mastercard, Visa as large global card schemes. Even though they're recognized globally, other payment methods like online banking, direct debit, digital wallets, or Buy Now Pay Later (BNPL) are more common elsewhere.

Offering secure payment methods will increase your brand trust and can reduce the potential for fraud. Account-to-account payments eliminate any risk of card payment fraud. This payment method allows consumers to pay directly from their bank account and cuts out any intermediaries.

What is a term of payment? A term of payment, also sometimes called payment term, is documentation that details how and when your customers pay for your goods or services. Terms of payment set your business's expectations for payment, including when clients pay and what penalties they may receive for missed payments.

A payment type defines how a particular payment method should be used and configured. Payment method, on the other hand, refers to how a customer settles their check (e.g., cash, voucher, credit card, etc.).

Consequently , RTGS payments happen faster, as the amount is reflected in the payee's account within 30 minutes of initiation of payment at the remitter's end. On the other hand, NEFT fulfilment is reflected within 2 hours. Secondly, the RTGS system has a minimum threshold amount of 2 lakhs.

Debit, credit, and prepaid cards

The next types of payment involve cards. Credit cards are issued by credit service providers like Visa, Mastercard, and American Express. Debit cards are issued by the customer's own bank and linked to their bank account.

1. Credit cards. The most familiar form of online payment is also one of the most secure payment methods. Credit card transactions are encrypted, which means the details are jumbled up and encoded.

ACH (Automated Clearing House) transfers are one of the most affordable ways to receive payments online. The fees involved are usually much lower than those charged by credit or debit card companies. This makes ACH transfers very popular in the world of ecommerce.

Cashier's checks usually are regarded as the safer bet because the funds are drawn against the bank's account, not an individual person's or business's account.

What are the stages of payment processing?

- A payment is made. ...

- The checkout is verified. ...

- The funds are stored. ...

- The funds are released. ...

- The funds are captured. ...

- The funds are received.

- Step 1: Payment Authorization. The first step to cc processing is payment authorization. ...

- Step 2: Payment Authentication. The payment authentication stage for small businesses is the second credit card processing stage. ...

- Step 3: Clearing.

| Best for | Standout feature | |

|---|---|---|

| PayPal | First-time users | Extremely simple setup |

| Stripe | Accessible analytics | Flexible, with a wide range of tools and plugins |

| Shopify Payments | eCommerce stores | All-in-one eCommerce solution |

| Square | Selling online and offline | Includes a basic website builder |

Fraud Risks

Chargebacks occur when a transaction is disputed and payment is returned to the card. With credit card payments having the highest dispute rate of all payment methods, you need to stay on top of transactions with a strong payment screening and transaction monitoring system.

Payment documents refer to any printed output required to support a payment produced by Payment Run (PYR) or collected by Payment Collection Run (PYC). This typically includes cheques and remittance advice but can also include any other type of printed payment schedule or output required.