What is an online bill payment?

Online bill pay is a digital service that allows businesses to offer customers the option to pay their bill online. Customers can make payments directly from their bank account, credit card, or other payment method to the business using online bill pay.

Usually, online bill-pay services work by having a linked checking account where the funds are withdrawn from. Some banks refer to the account that pays the bill as the “pay from” account, while the business or individual who receives the bill payment is designated as the “pay to” account.

- Utilities like gas and electricity.

- Communications like phone, cable and internet.

- Rent or mortgage.

- Credit cards.

- Auto loans.

- Gym memberships.

- Ongoing charitable donations.

Bill payment is a facility provided to the customer to make their utility payments online through digital banking. The customer has different utility payments like Electricity Bill payment, Mobile bill payments, Water bill payments, insurance payments, etc.

While bill pay and autopay are similar, they work differently. With online bill pay, your bank sends payments to your creditor from your account. With autopay, your creditor takes money from your account. Here's how to decide which method is best for you.

Security: Online bill pay is more secure than paying bills with paper checks. Your financial information is encrypted when you send payments online, which makes it difficult for scammers to steal it. Convenience: Online bill pay is convenient.

Online bill paying can be an expensive component to online banking as some companies will charge fees (See Online Banking Fees). If you've set up automatic bill payment and need to stop those payments, the process can take a while. With the ease of automatic bill payment, it's easy to forget which bill is due when.

Online Bill Pay also puts you in control of your finances. You decide when your money leaves your account and you can set up recurring payments giving you the peace of mind that your bills will be paid on time. Payment amounts can be changed and payments can be cancelled before they are sent.

It's convenient

When you make online payments through your bank, you can pay all of your bills from a central location rather than logging into multiple websites. And you avoid the hassle of paper bills, checks, stamps and mailing. You can even schedule some bills to be paid as soon as the next business day.

Banks and credit unions often offer online bill pay as a free service to customers. It can be an easy and convenient way to manage, track and pay bills directly from your account. With bill pay, you can add new companies or people—called payees—to your account and then send one-time or recurring payments.

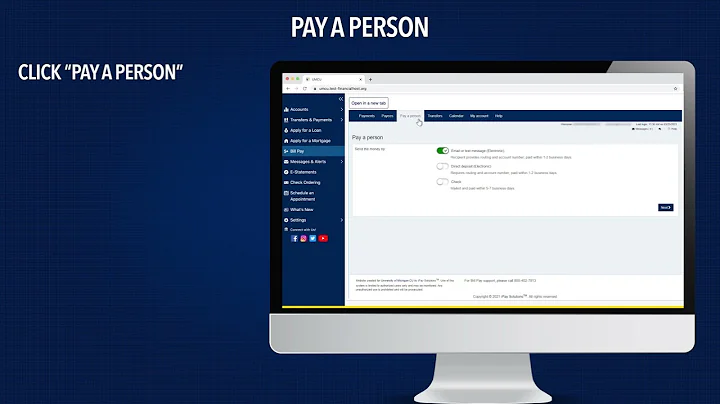

How do I set up online bill pay?

First, enroll for services with your bank online. This will allow you to access your checking account through your bank's website. Then sign up for the bill payment service and add all of the accounts you plan to use the service for.

Use a credit card instead of a debit card for online bill pay to dispute any fraudulent charges that may pop up. Don't use public Wi-Fi when accessing your account. Keep your computer's security software and operating system up to date.

The payee may take 3 to 5 business days to post the payment to your account. In addition, some payees only accept the date they actually process your payment and not the date you make your payment in Online Banking.

Most bill payments are sent electronically. However, some may be sent as paper checks if the amount is above the electronic payment threshold, or the company doesn't accept electronic payments.

In 2022, 67% of respondents say they made a bill payment via mobile device compared to 63% who said they made a bill payment through an online portal (more than one choice was possible).

It's generally safer to use your bank's online bill pay because you have more control over the payment process. You set the amount and date of payment rather than allowing the service provider to take the money from your bank account on their terms.

Use official websites, platforms, and apps.

Although your mobile pay platform may be secure, this means very little if a malicious app is downloaded onto your device. Such apps may contain viruses, worms, or malware, among other forms of harmful content.

Most bill pay transactions are executed as electronic transfers. However, some payment recipients, including many individuals, do not have accounts that enable them to receive electronic payments from individual payers and must instead accept a paper check.

If they're FDIC-insured, online banks are as safe as traditional brick-and-mortar banks in many ways. You can also take steps as a consumer to ensure your account is as protected as possible when banking online, whether you bank with a brick-and-mortar or an online bank, also called a direct or digital bank.

We asked U.S. consumers about "Most used online payments by brand" and found that "PayPal" takes the top spot, while "Skrill" is at the other end of the ranking. Find this and more survey data on most used online payments by brand in our Consumer Insights tool.

Is online bill pay easier and cheaper?

If you need to a pay bill, paying it online is likely the cheapest and easiest way to do it, if that's an option. With online bill pay, there's no need to purchase a money order or write a check and then track down stamps and find a mailbox.

Your bank or credit union

Almost every major bank and credit union offers this service, including Chase, Wells Fargo, Discover, Bank of America and Ally. Most bill pay services are free as long as you have an active checking account with the bank or credit union.

Your bank will take all of its daily transactions and submit them in a batch file to the automated clearing house (ACH) network. This processes large volumes of credit and debit transactions at once.

If you don't have an account number, you can enter other information that identifies you to the biller in the account number box. Check your bill or statement for an invoice number, your service address, or the name on the account. If you're adding a person to pay, you won't need to enter an account number.

Pay Bills with a Money Order

They never expire, and you can even put a stop payment on them if you need to. For a small fee, you essentially trade your cash for a money order in the exact amount of your bill. You fill out the money order and then either mail it or bring it to the business billing you.