What is the investment strategy?

An investment strategy is a plan designed to help individual investors achieve their financial and investment goals. Your investment strategy depends on your personal circ*mstances, including your age, capital, risk tolerance, and goals.

An investment strategy is a plan designed to help individual investors achieve their financial and investment goals. Your investment strategy depends on your personal circ*mstances, including your age, capital, risk tolerance, and goals.

investment by a company that is intended to make it more successful over time, for example investment in a new business that offers new markets or that is developing new products: We see this acquisition as a strategic investment.

- 1 Assess your goals. Before you invest, you need to have a clear idea of what you want to accomplish and when. ...

- 2 Choose your asset allocation. ...

- 3 Diversify your portfolio. ...

- 4 Review your performance. ...

- 5 Adjust your strategy.

An investment is an asset or item acquired with the goal of generating income or appreciation. Appreciation refers to an increase in the value of an asset over time. When an individual purchases a good as an investment, the intent is not to consume the good but rather to use it in the future to create wealth.

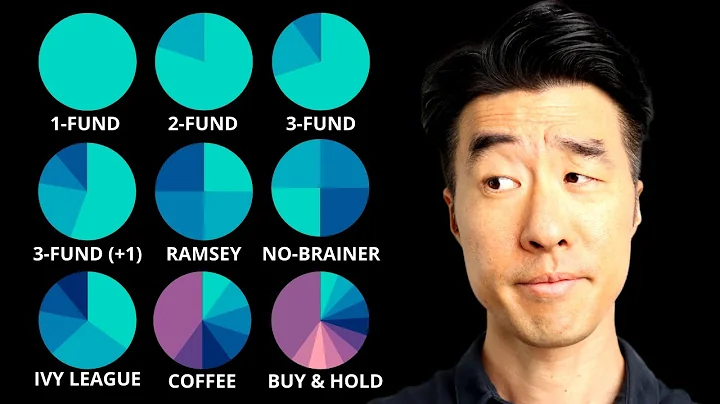

The three-fund portfolio consists of a total stock market index fund, a total international stock index fund, and a total bond market fund. Asset allocation between those three funds is up to the investor based on their age and risk tolerance.

Strategic investment deals are structured as a common or preferred share financing from a company (for example, Cisco, Intel, Google) investing in startup companies developing technologies complementary to their businesses.

An investment strategy helps you to stay focused and disciplined, allowing you to make informed decisions based on your financial goals, risk tolerance, and time horizon. It also helps you to diversify your portfolio, reducing your risk and increasing your chances of success.

- Define clear examples of your focus areas. ...

- Think about the objectives that could fall under that focus area. ...

- Set measurable targets (KPIs) to tackle the objective. ...

- Implement related projects to achieve the KPIs. ...

- Utilize Cascade Strategy Execution Platform to see faster results from your strategy.

It's a plan to help you achieve your goals, and to help you make decisions that will maximize your return on investment. There are many different investment strategies, and the 1 that's right for you will depend on factors, such as: If you're investing to meet short-, medium- or long-term goals. Your risk appetite.

What is the step four strategic investing?

Step Four: Strategic Investing

The key here is diversification–making sure you're not keeping all your eggs in one basket. Since stocks and bonds often respond oppositely to market conditions, lots of people invest in both to balance out potential losses. Goals in this stage are medium-term: five to 10 years.

The best investment options for tax saving in India include Public Provident Fund (PPF), National Pension System (NPS), Equity Linked Savings Scheme (ELSS), Tax Savings Fixed Deposit, Unit Linked Insurance Plans (ULIPs), and National Savings Certificate (NSC). Where to Invest Money In 2024?

When working on investment word problems, you will want to substitute all given information into the I = Prt equation, and then solve for whatever is left. You put $1000 into an investment yielding 6% annual interest; you left the money in for two years. How much interest do you get at the end of those two years?

An investment decision could involve purchasing new equipment, investing in research and development, buying new property, or expanding into new markets. These decisions often have long-term implications and are influenced by a multitude of factors.

There's much debate about the relative merits of active and passive — two common investing styles — which are based on very different views of how capital markets operate. You can find out more about active and passive investing in Beyond the benchmark: active or passive investment management?

Growth investing is an investment style and strategy that is focused on increasing an investor's capital. Growth investors typically invest in growth stocks—that is, young or small companies whose earnings are expected to increase at an above-average rate compared to their industry sector or the overall market.

Investment Types: Strategic investments can take many forms, such as buying equity stakes in other businesses, forming strategic partnerships, or engaging in mergers and acquisitions. Each type has its own set of potential benefits and challenges. Your strategic goals should guide your choice of investment.

Cash is the most liquid asset possible as it is already in the form of money. This includes physical cash, savings account balances, and checking account balances.

The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional.

Perhaps the most common are stocks, bonds, real estate, and ETFs/mutual funds. Other types of investments to consider are real estate, CDs, annuities, cryptocurrencies, commodities, collectibles, and precious metals.

What is the safest investment with the highest return?

- High-yield savings accounts.

- Money market funds.

- Short-term certificates of deposit.

- Series I savings bonds.

- Treasury bills, notes, bonds and TIPS.

- Corporate bonds.

- Dividend-paying stocks.

- Preferred stocks.

Growth investments are for long-term investing. Growth investments usually carry a higher risk than either safety or income investments. Speculation is the riskiest investment. With the high risk usually comes the possibility of higher gains.

In our experience it's a focus on four key principles: Developing a plan and then sticking to it. Relentless focus on driving business value through benefits realisation. Leadership involvement and communication.

The U.S. stock market is considered to offer the highest investment returns over time. Higher returns, however, come with higher risk. Stock prices typically are more volatile than bond prices. Stock prices over shorter time periods are more volatile than stock prices over longer time periods.

- Savings Accounts. ...

- Certificates of Deposit (CD) ...

- Dividend-Paying Stocks. ...

- Bonds. ...

- Annuities. ...

- Rental Real Estate. ...

- Real Estate Investment Trusts (REITs) ...

- Business Ownership.